Favorite Tips About How To Choose A Business Bank

Pennsylvania requires that every llc operating in the state have a unique name.

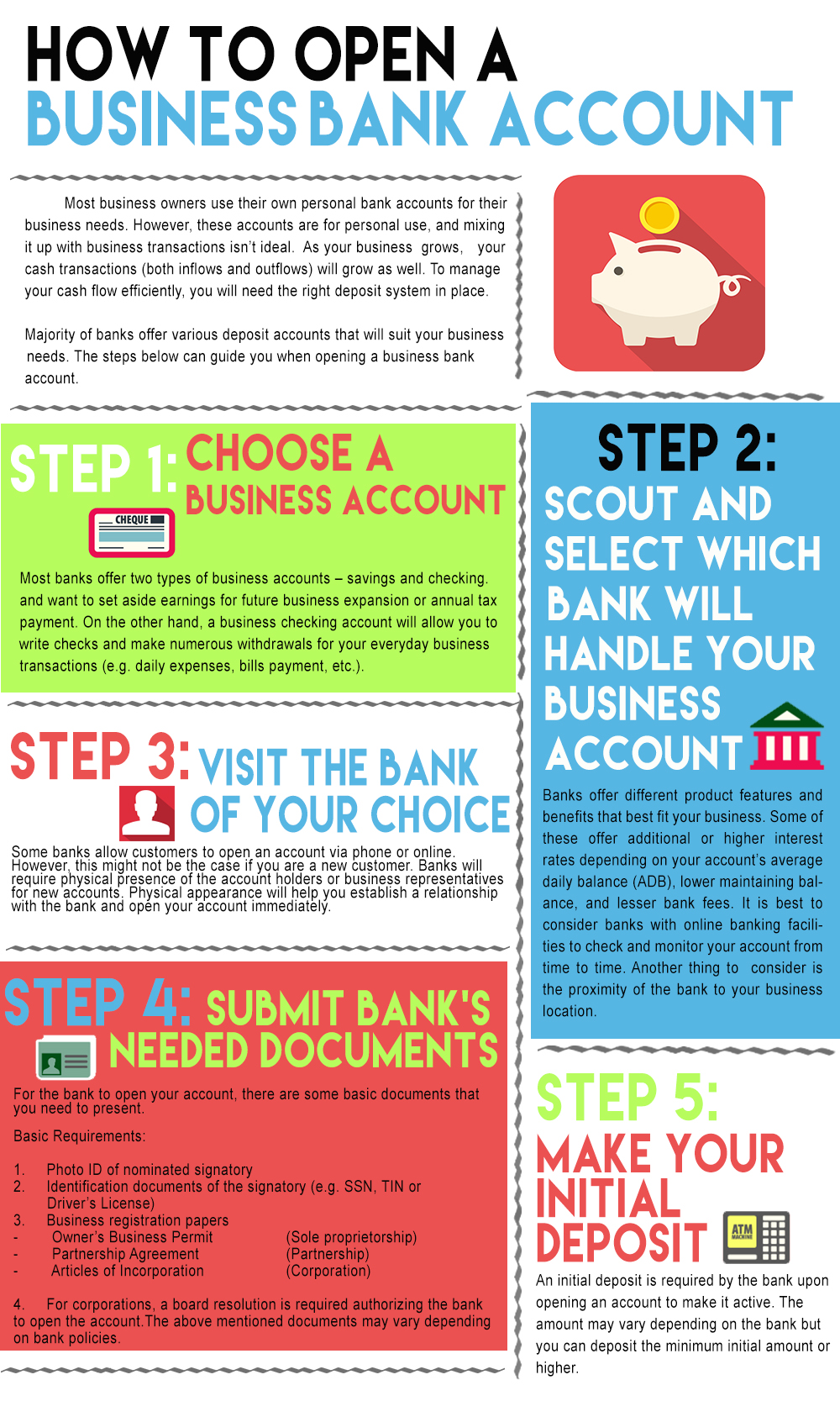

How to choose a business bank. Most important when deciding how to choose a business bank account is to discuss fully and openly with the bank how they can help. Choosing a bank for your business requires more thought and planning than simply walking into your personal bank and opening up a second account. Fill out an application online or in.

Any business that is receiving. A bank representative may also be able to help you determine the best account for your needs. Get lowest rates & grow your business today!

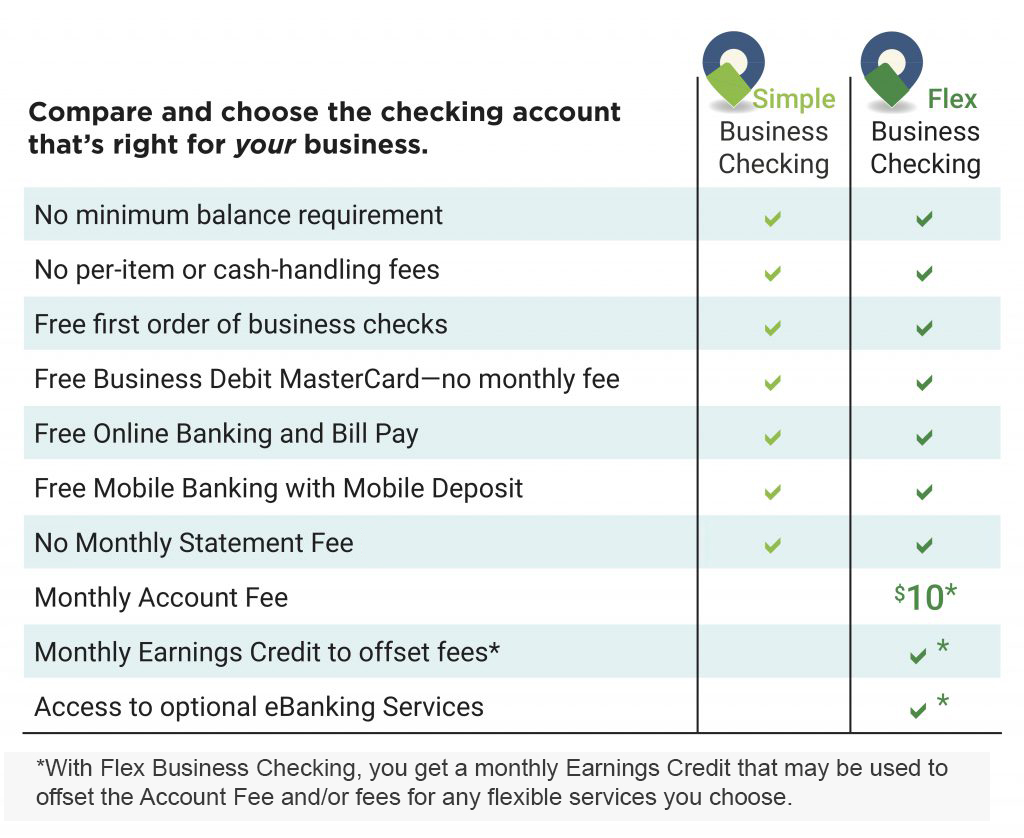

For example, the bank may ask you to maintain a minimum balance of $5,000 a month in your business checking account. With all the costs involved in running your own business, many business owners are looking for free business banking and low or no charges, wherever possible. Especially for startups or truly small businesses, forming a relationship with your bank has advantages.

No hidden fees, services and support built for your business, and rewards like 1.5% interest on checking for eligible customers. At a 3% rate, you’ll earn more than $760 in a year. Ad convenient access to your business checking account with 24/7 mobile banking.

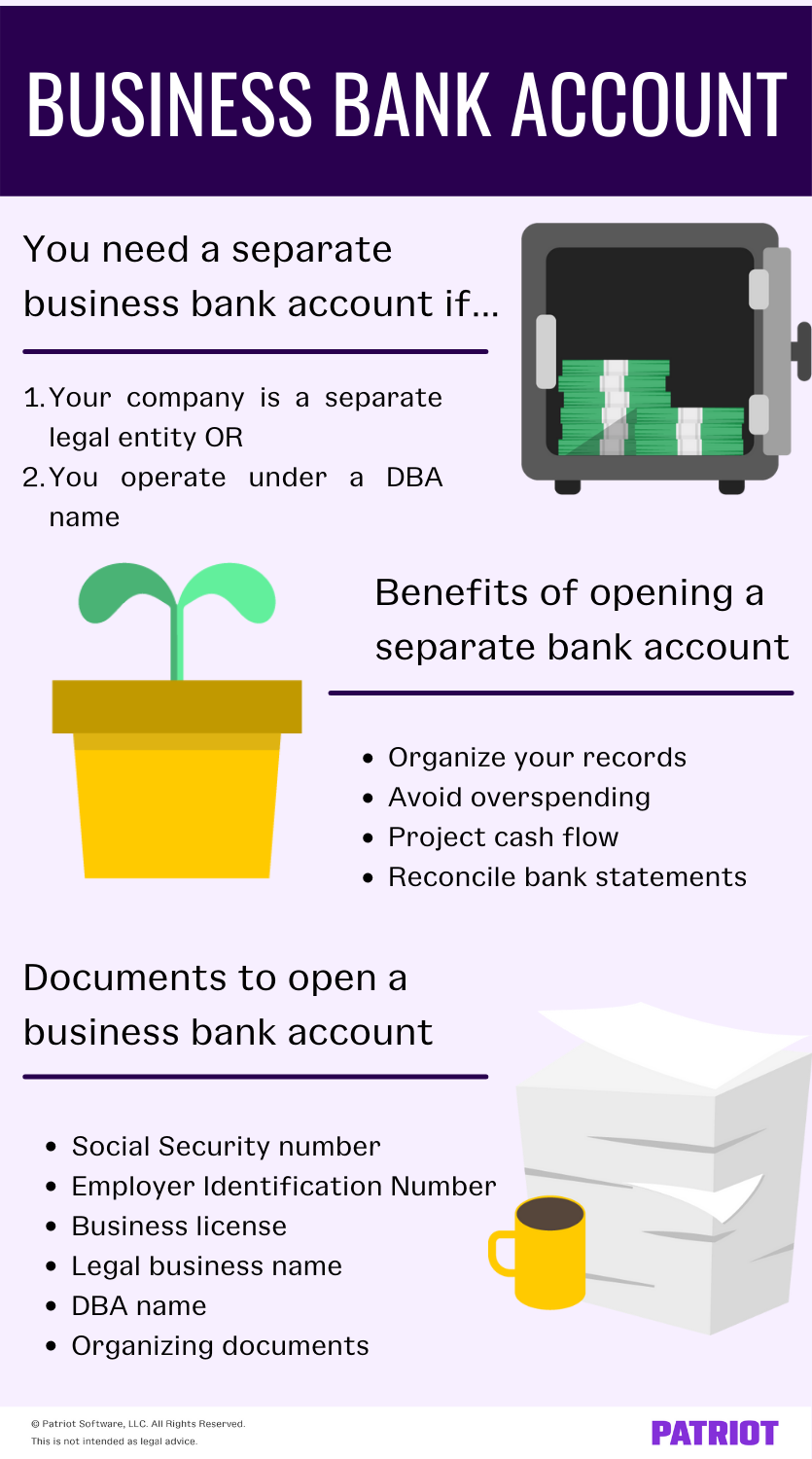

How to choose a business bank account. Choose a business bank account that fits how you plan to use that account. Gather your important information (id, proof of address etc.).

The size of the bank. Keep these thoughts in mind. If not, they may charge you a $20 fee.